Cash is King - Get better visibility of your cashflow in Dynamics 365 Business Central & NAV

Reading time: 2 - 3 minutes

In the current business climate, more than ever, it is vital to have a clear view of your cashflow situation. Many companies are doing this with off system tools like Excel spreadsheets, but there are built-in tools within Microsoft Dynamics 365 Business Central and Dynamics NAV.

Three tools you could use are the Receivables/Payables report, the built-in Account Schedules and their linked mini charts or the full Cash Flow module.

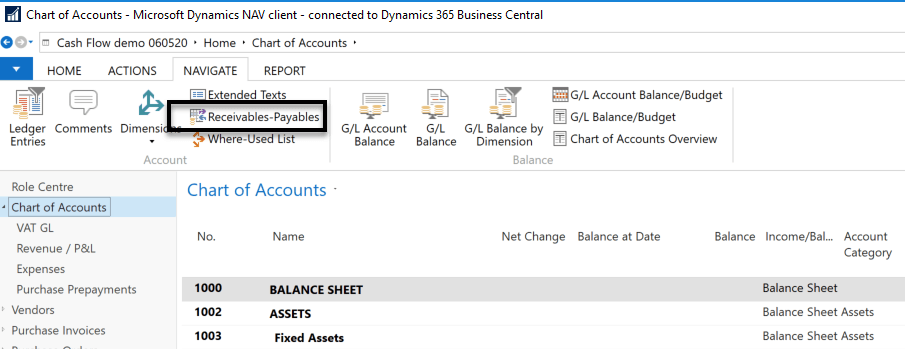

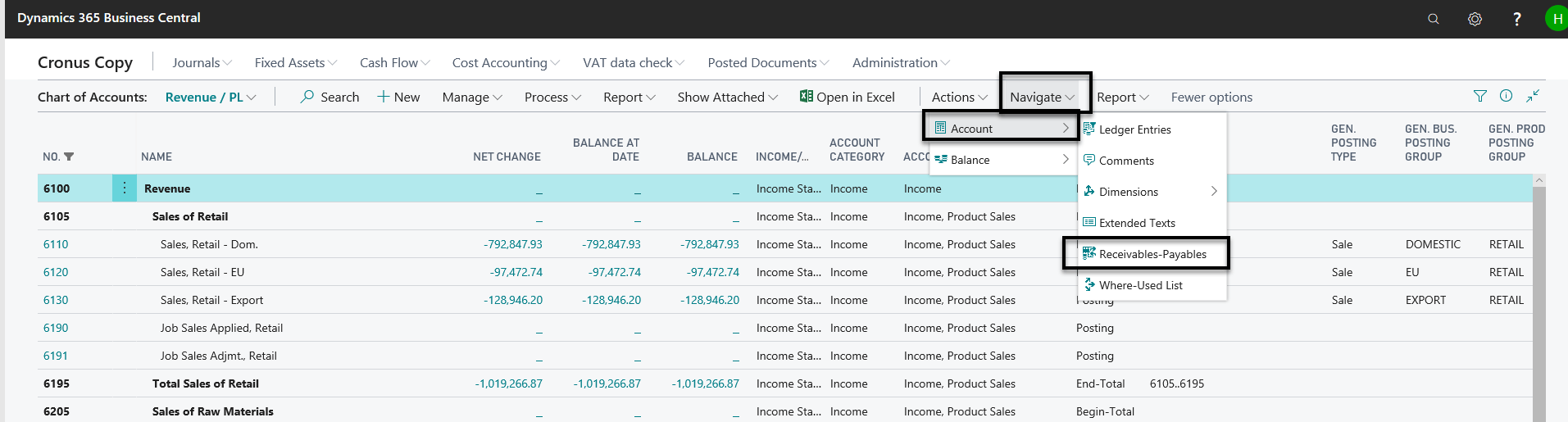

Receivables/Payables Report

This is found on the 'Navigate' tab of the ribbon of the 'Chart of Accounts' if you are using Dynamics NAV or the Navigate drop-down menu if you are using Dynamics 365 Business Central.

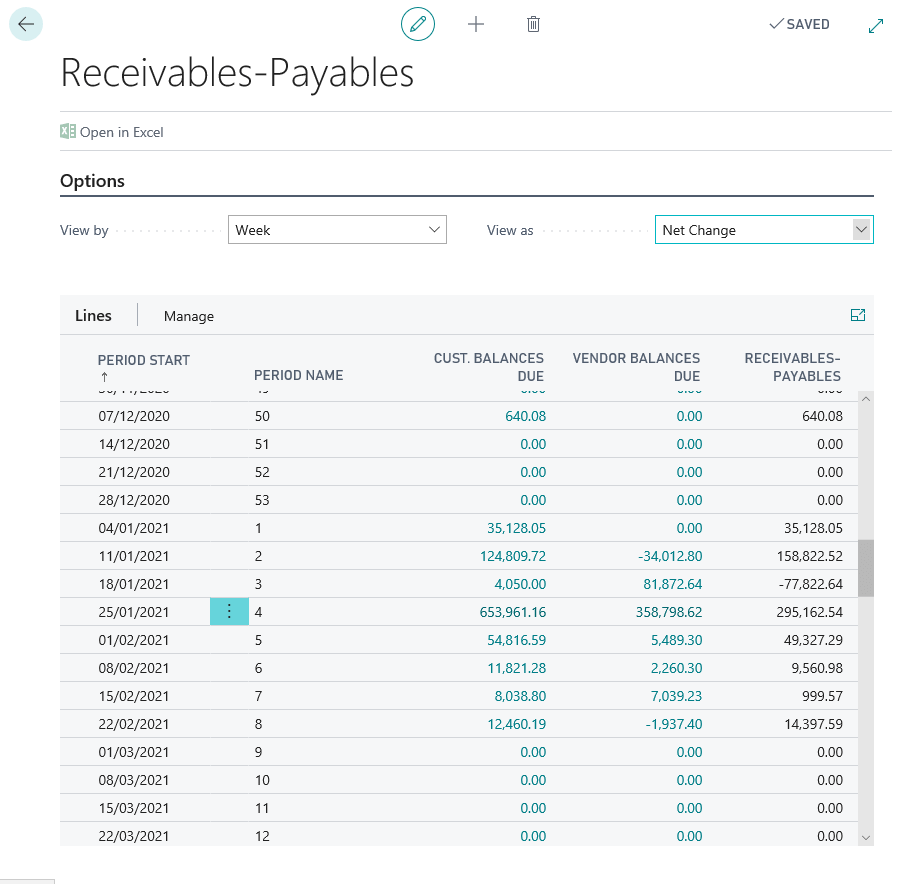

This produces a view of all the Payables and Receivables for a period. The View By option can be set to Day, Week, Month, Quarter, Year or Period and View As can be Net Change or Balance at Date.

The figures can be drilled into to reveal the underlying 'Customer Ledger Entries' or 'Vendor Ledger Entries'.

This is also the limitation of this feature, it’s using the 'Due Date' on the 'Customer Ledger Entry' (for example) which is set using the Payment Terms for the customer - and they all don't pay on time, do they?

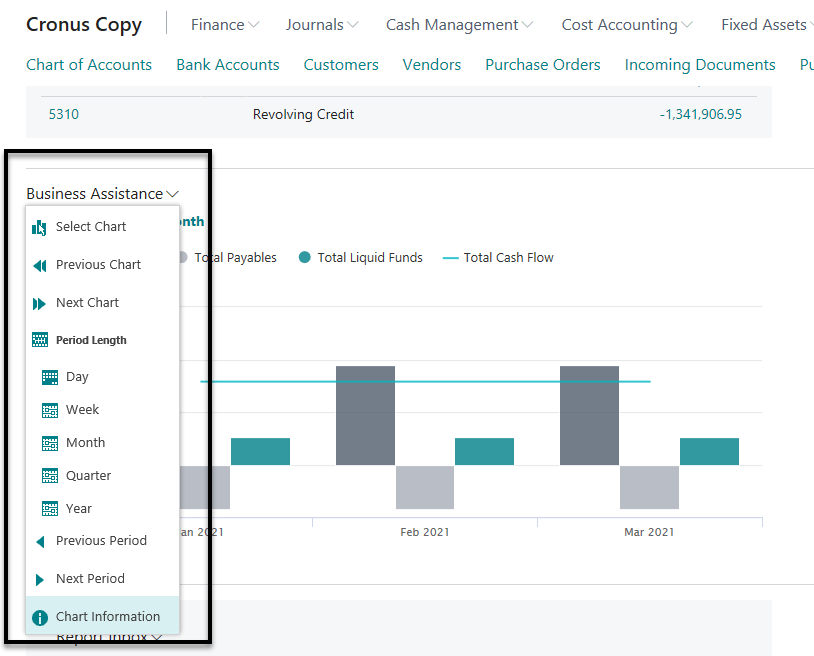

Account Schedules & the Business Assistance mini charts

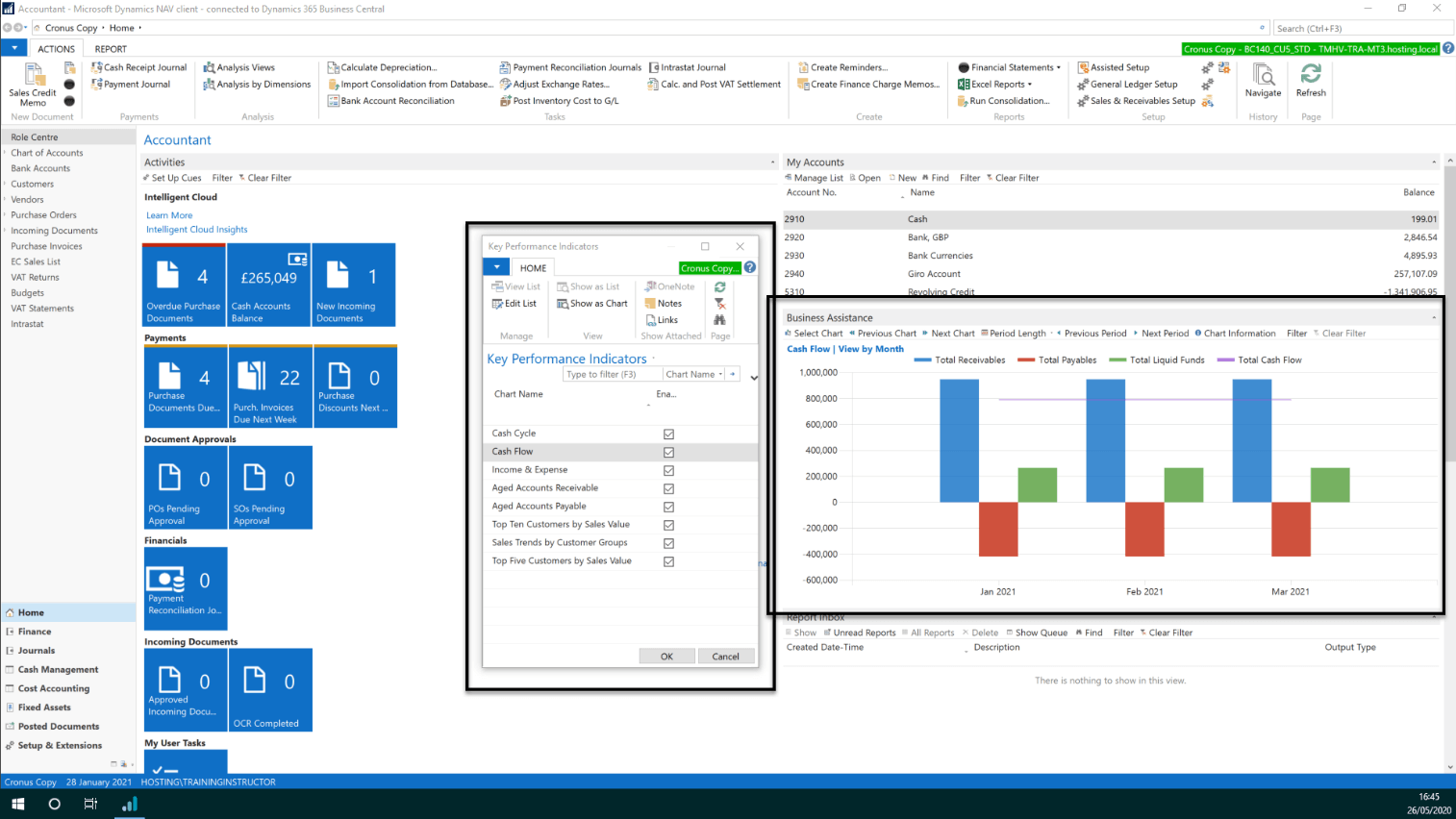

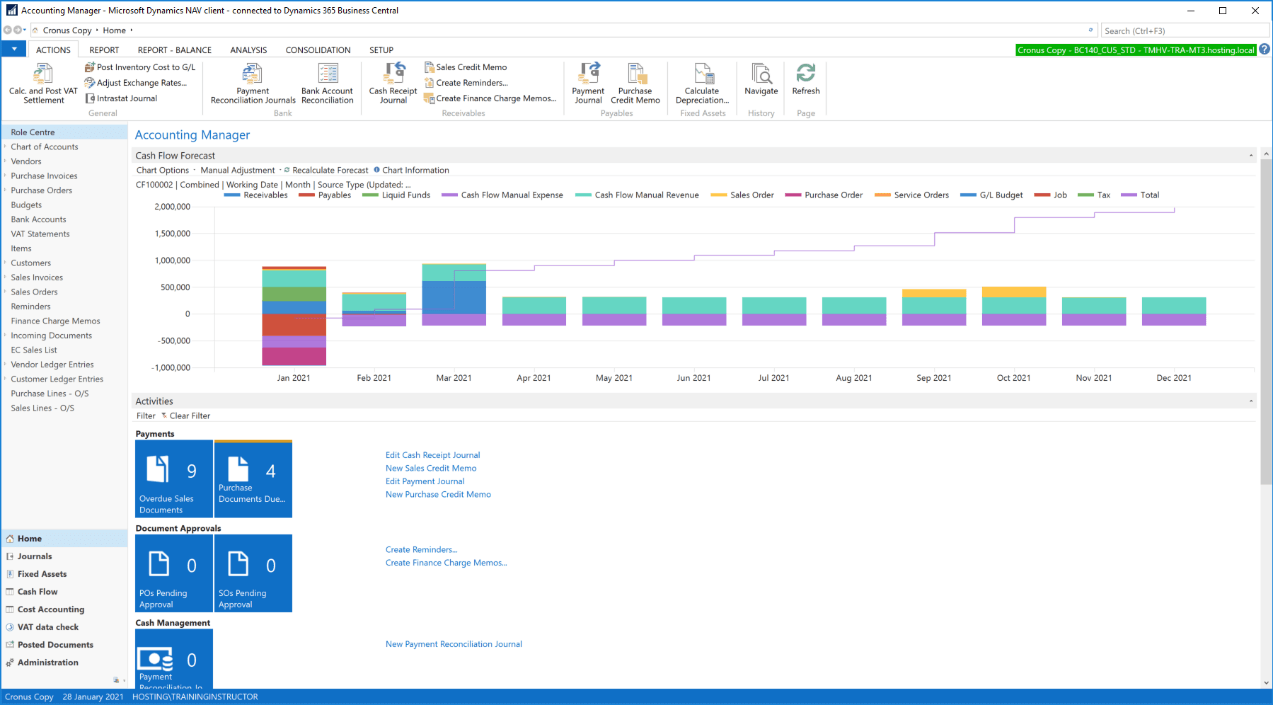

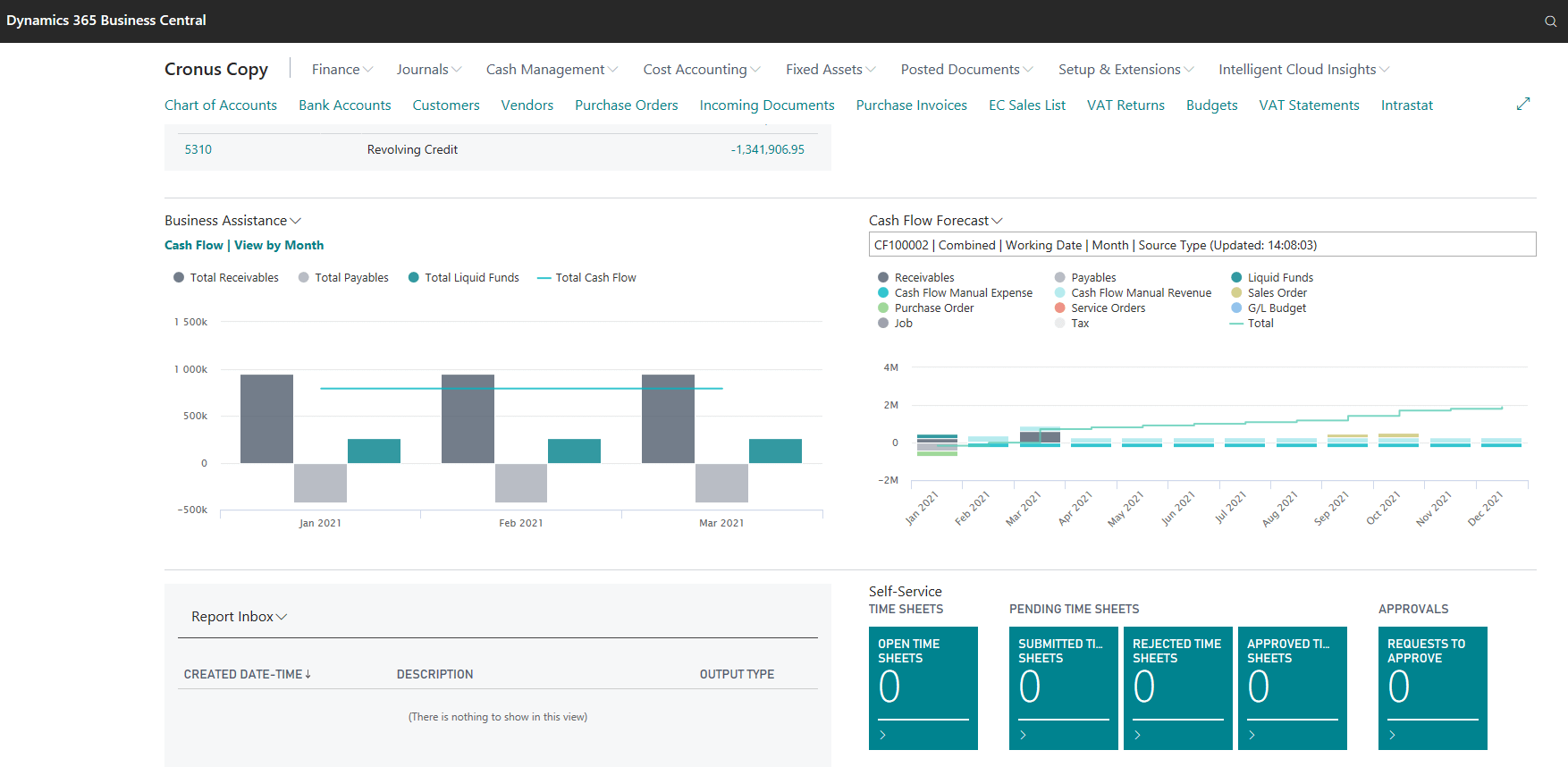

The 'Accountant' Role Centre does include a 'Business Assistance' part, which contains multiple charts in one part.

The 'Select Chart' option gives direct access to the Key Performance Indicators and allows some to be deselected.

There is a Cash Flow mini chart, a Cash Cycle mini chart and an Income & Expense mini chart.

Within the mini chart, each element can be clicked to see the underlying data. The same limitation applies here though, it is assuming that your receivables will be paid on time.

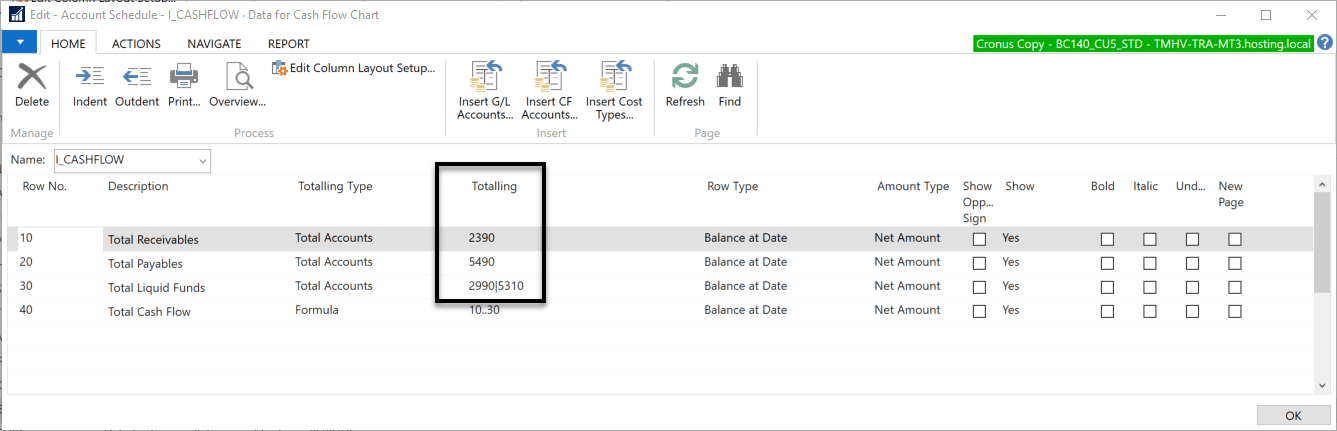

These do require a small amount of setting up but it’s fairly straight forward. These charts are using some of the default 'Account Schedules' in the background for their data, this includes I_CACYCLE, I_CASHFLOW and I_INCEXP. These are likely to need some ‘tweaking’ to ensure they reference the correct nominals in your company, by default they will be set for the Cronus demo company chart of accounts. The 'Totalling' account reference will need to be updated in all of them to reflect your actual Chart of Accounts.

We offer a separate one-hour training module covering Account Schedules, these are well worth exploring further as a bespoke finance reporting tool.

Cash Flow module

This is the big one. It can be used to predict the future cash flow in your business, taking data from a wide variety of sources such as Receivables, Payables, open Sales Orders, open Purchase orders, Jobs, Fixed Assets, Tax/VAT and can even use Artificial Intelligence to refine the forecast based on your transaction history.

One of the main benefits of this module is that it allows the Due Date of your receivables to be complemented with a Cash Flow Date, that makes things more realistic so when you have a customer that is on 30-day payment terms but generally pays you on 40 days you can make the system reflect this. The system can also take account of known things that can’t be posted yet like salary costs or finance costs by using Cash Flow Manual Expenses (and Revenue if required).

All of this can then help your analysis, with some built-in reports and a Cash Flow chart that you can interrogate.

Next steps

Firstly, all of the features mentioned here are standard tools you can just start using. If you decide you want a bit of help with understanding Account Schedules (they are a favourite of many Finance teams) or the full Cash Flow module itself then contact your account manager to ask about our one-hour remote training sessions covering these and many more topics.

Alternatively, get in touch.